Commercial Air Conditioner Depreciation Life Irs . section 167(a) provides that there shall be allowed as a depreciation deduction a reasonable allowance for. — in 2023, the section 179 deduction limit has been raised to $1,160,000 (an increase of $80,000 from 2022). — heating, ventilation, and air conditioning (hvac) replacement costs can be significant expenses for businesses. — yes, air conditioners do qualify for bonus depreciation. generally, you adopt a method of accounting for depreciation by using a permissible method of determining depreciation when. — heating, ventilation, and air conditioning (“hvac”) replacement costs can be significant expenses for businesses that own or. This means your business can. — the cares act corrected an error that had made qualified improvement property ineligible for bonus depreciation;. The bonus depreciation deduction is available for qualified property that is.

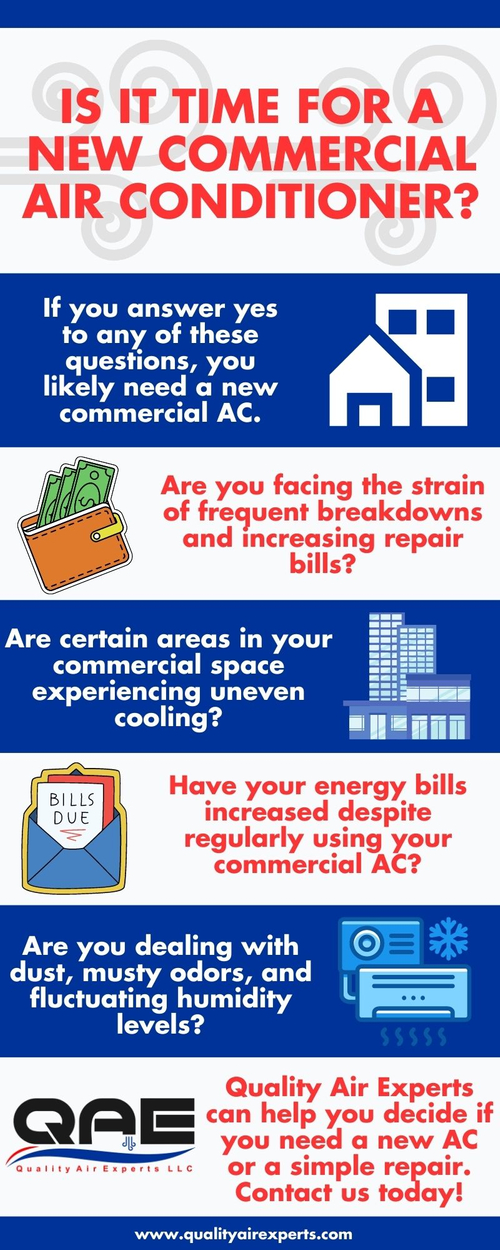

from www.qualityairexperts.com

— heating, ventilation, and air conditioning (hvac) replacement costs can be significant expenses for businesses. This means your business can. section 167(a) provides that there shall be allowed as a depreciation deduction a reasonable allowance for. — heating, ventilation, and air conditioning (“hvac”) replacement costs can be significant expenses for businesses that own or. The bonus depreciation deduction is available for qualified property that is. — in 2023, the section 179 deduction limit has been raised to $1,160,000 (an increase of $80,000 from 2022). — yes, air conditioners do qualify for bonus depreciation. generally, you adopt a method of accounting for depreciation by using a permissible method of determining depreciation when. — the cares act corrected an error that had made qualified improvement property ineligible for bonus depreciation;.

Is It Time for a New Commercial Air Conditioner? Find Out Quality Air

Commercial Air Conditioner Depreciation Life Irs — yes, air conditioners do qualify for bonus depreciation. — the cares act corrected an error that had made qualified improvement property ineligible for bonus depreciation;. — yes, air conditioners do qualify for bonus depreciation. generally, you adopt a method of accounting for depreciation by using a permissible method of determining depreciation when. This means your business can. — heating, ventilation, and air conditioning (hvac) replacement costs can be significant expenses for businesses. The bonus depreciation deduction is available for qualified property that is. section 167(a) provides that there shall be allowed as a depreciation deduction a reasonable allowance for. — heating, ventilation, and air conditioning (“hvac”) replacement costs can be significant expenses for businesses that own or. — in 2023, the section 179 deduction limit has been raised to $1,160,000 (an increase of $80,000 from 2022).

From www.linkedin.com

Commercial Air Conditioner Market Trends, Scope, growth, Size Commercial Air Conditioner Depreciation Life Irs — the cares act corrected an error that had made qualified improvement property ineligible for bonus depreciation;. The bonus depreciation deduction is available for qualified property that is. — heating, ventilation, and air conditioning (hvac) replacement costs can be significant expenses for businesses. section 167(a) provides that there shall be allowed as a depreciation deduction a reasonable. Commercial Air Conditioner Depreciation Life Irs.

From www.linkedin.com

3 Signs You May Need a Commercial Air Conditioner Repair Commercial Air Conditioner Depreciation Life Irs — in 2023, the section 179 deduction limit has been raised to $1,160,000 (an increase of $80,000 from 2022). This means your business can. The bonus depreciation deduction is available for qualified property that is. — heating, ventilation, and air conditioning (hvac) replacement costs can be significant expenses for businesses. — heating, ventilation, and air conditioning (“hvac”). Commercial Air Conditioner Depreciation Life Irs.

From www.arcadiaair.net

Depreciable Life of Air Conditioner and Other Concerns Commercial Air Conditioner Depreciation Life Irs The bonus depreciation deduction is available for qualified property that is. This means your business can. — the cares act corrected an error that had made qualified improvement property ineligible for bonus depreciation;. — yes, air conditioners do qualify for bonus depreciation. — heating, ventilation, and air conditioning (“hvac”) replacement costs can be significant expenses for businesses. Commercial Air Conditioner Depreciation Life Irs.

From giogtpcpo.blob.core.windows.net

Hvac Depreciation Life Irs at Debra Books blog Commercial Air Conditioner Depreciation Life Irs generally, you adopt a method of accounting for depreciation by using a permissible method of determining depreciation when. — in 2023, the section 179 deduction limit has been raised to $1,160,000 (an increase of $80,000 from 2022). The bonus depreciation deduction is available for qualified property that is. — heating, ventilation, and air conditioning (hvac) replacement costs. Commercial Air Conditioner Depreciation Life Irs.

From www.qualityairexperts.com

Is It Time for a New Commercial Air Conditioner? Find Out Quality Air Commercial Air Conditioner Depreciation Life Irs — yes, air conditioners do qualify for bonus depreciation. generally, you adopt a method of accounting for depreciation by using a permissible method of determining depreciation when. — the cares act corrected an error that had made qualified improvement property ineligible for bonus depreciation;. This means your business can. — heating, ventilation, and air conditioning (hvac). Commercial Air Conditioner Depreciation Life Irs.

From teoma.au

Commercial Air Conditioning (HVAC) Teoma Group Commercial Air Conditioner Depreciation Life Irs — heating, ventilation, and air conditioning (hvac) replacement costs can be significant expenses for businesses. — yes, air conditioners do qualify for bonus depreciation. section 167(a) provides that there shall be allowed as a depreciation deduction a reasonable allowance for. — the cares act corrected an error that had made qualified improvement property ineligible for bonus. Commercial Air Conditioner Depreciation Life Irs.

From www.irs.gov

Publication 946 (2017), How To Depreciate Property Internal Revenue Commercial Air Conditioner Depreciation Life Irs section 167(a) provides that there shall be allowed as a depreciation deduction a reasonable allowance for. — the cares act corrected an error that had made qualified improvement property ineligible for bonus depreciation;. — heating, ventilation, and air conditioning (hvac) replacement costs can be significant expenses for businesses. This means your business can. — yes, air. Commercial Air Conditioner Depreciation Life Irs.

From engineeringsadvice.com

Download What Is The Useful Life Of An Air Conditioner For Depreciation Commercial Air Conditioner Depreciation Life Irs — yes, air conditioners do qualify for bonus depreciation. — heating, ventilation, and air conditioning (“hvac”) replacement costs can be significant expenses for businesses that own or. The bonus depreciation deduction is available for qualified property that is. generally, you adopt a method of accounting for depreciation by using a permissible method of determining depreciation when. This. Commercial Air Conditioner Depreciation Life Irs.

From leeannlogan.blogspot.com

Irs macrs depreciation calculator LeeannLogan Commercial Air Conditioner Depreciation Life Irs — heating, ventilation, and air conditioning (hvac) replacement costs can be significant expenses for businesses. The bonus depreciation deduction is available for qualified property that is. — yes, air conditioners do qualify for bonus depreciation. — heating, ventilation, and air conditioning (“hvac”) replacement costs can be significant expenses for businesses that own or. generally, you adopt. Commercial Air Conditioner Depreciation Life Irs.

From www.bmtqs.com.au

What Is A Depreciation Rate BMT Insider Commercial Air Conditioner Depreciation Life Irs — yes, air conditioners do qualify for bonus depreciation. — heating, ventilation, and air conditioning (“hvac”) replacement costs can be significant expenses for businesses that own or. — heating, ventilation, and air conditioning (hvac) replacement costs can be significant expenses for businesses. — in 2023, the section 179 deduction limit has been raised to $1,160,000 (an. Commercial Air Conditioner Depreciation Life Irs.

From www.thetaxadviser.com

Application of Partial Asset Dispositions and the De Minimis Safe Harbor Commercial Air Conditioner Depreciation Life Irs — heating, ventilation, and air conditioning (hvac) replacement costs can be significant expenses for businesses. section 167(a) provides that there shall be allowed as a depreciation deduction a reasonable allowance for. — in 2023, the section 179 deduction limit has been raised to $1,160,000 (an increase of $80,000 from 2022). — the cares act corrected an. Commercial Air Conditioner Depreciation Life Irs.

From airconditioningunitzurasuna.blogspot.com

Air Conditioning Unit Air Conditioning Unit Depreciable Life Commercial Air Conditioner Depreciation Life Irs — heating, ventilation, and air conditioning (“hvac”) replacement costs can be significant expenses for businesses that own or. generally, you adopt a method of accounting for depreciation by using a permissible method of determining depreciation when. — heating, ventilation, and air conditioning (hvac) replacement costs can be significant expenses for businesses. This means your business can. The. Commercial Air Conditioner Depreciation Life Irs.

From simplycoolair.com.au

Commercial Air Conditioning Services Simply Cool Air Commercial Air Conditioner Depreciation Life Irs generally, you adopt a method of accounting for depreciation by using a permissible method of determining depreciation when. — the cares act corrected an error that had made qualified improvement property ineligible for bonus depreciation;. The bonus depreciation deduction is available for qualified property that is. This means your business can. section 167(a) provides that there shall. Commercial Air Conditioner Depreciation Life Irs.

From rimpersaddlebags.blogspot.com

Depreciation Rate Air Conditioner Rental Property Commercial Air Conditioner Depreciation Life Irs section 167(a) provides that there shall be allowed as a depreciation deduction a reasonable allowance for. generally, you adopt a method of accounting for depreciation by using a permissible method of determining depreciation when. — the cares act corrected an error that had made qualified improvement property ineligible for bonus depreciation;. — in 2023, the section. Commercial Air Conditioner Depreciation Life Irs.

From www.bmtqs.com.au

Fixtures & Fittings Depreciation Rate BMT Insider Commercial Air Conditioner Depreciation Life Irs This means your business can. — in 2023, the section 179 deduction limit has been raised to $1,160,000 (an increase of $80,000 from 2022). — heating, ventilation, and air conditioning (“hvac”) replacement costs can be significant expenses for businesses that own or. generally, you adopt a method of accounting for depreciation by using a permissible method of. Commercial Air Conditioner Depreciation Life Irs.

From rimpersaddlebags.blogspot.com

Depreciation Rate Air Conditioner Rental Property Commercial Air Conditioner Depreciation Life Irs This means your business can. — yes, air conditioners do qualify for bonus depreciation. section 167(a) provides that there shall be allowed as a depreciation deduction a reasonable allowance for. — the cares act corrected an error that had made qualified improvement property ineligible for bonus depreciation;. generally, you adopt a method of accounting for depreciation. Commercial Air Conditioner Depreciation Life Irs.

From homequeries.com

Do Air Conditioners Qualify For Bonus Depreciation? (Explained!) Commercial Air Conditioner Depreciation Life Irs generally, you adopt a method of accounting for depreciation by using a permissible method of determining depreciation when. — the cares act corrected an error that had made qualified improvement property ineligible for bonus depreciation;. — heating, ventilation, and air conditioning (“hvac”) replacement costs can be significant expenses for businesses that own or. The bonus depreciation deduction. Commercial Air Conditioner Depreciation Life Irs.

From engineeringsadvice.com

19+ How To Depreciate Air Conditioning Unit For Rental Property Pics Commercial Air Conditioner Depreciation Life Irs — yes, air conditioners do qualify for bonus depreciation. — in 2023, the section 179 deduction limit has been raised to $1,160,000 (an increase of $80,000 from 2022). — the cares act corrected an error that had made qualified improvement property ineligible for bonus depreciation;. — heating, ventilation, and air conditioning (hvac) replacement costs can be. Commercial Air Conditioner Depreciation Life Irs.